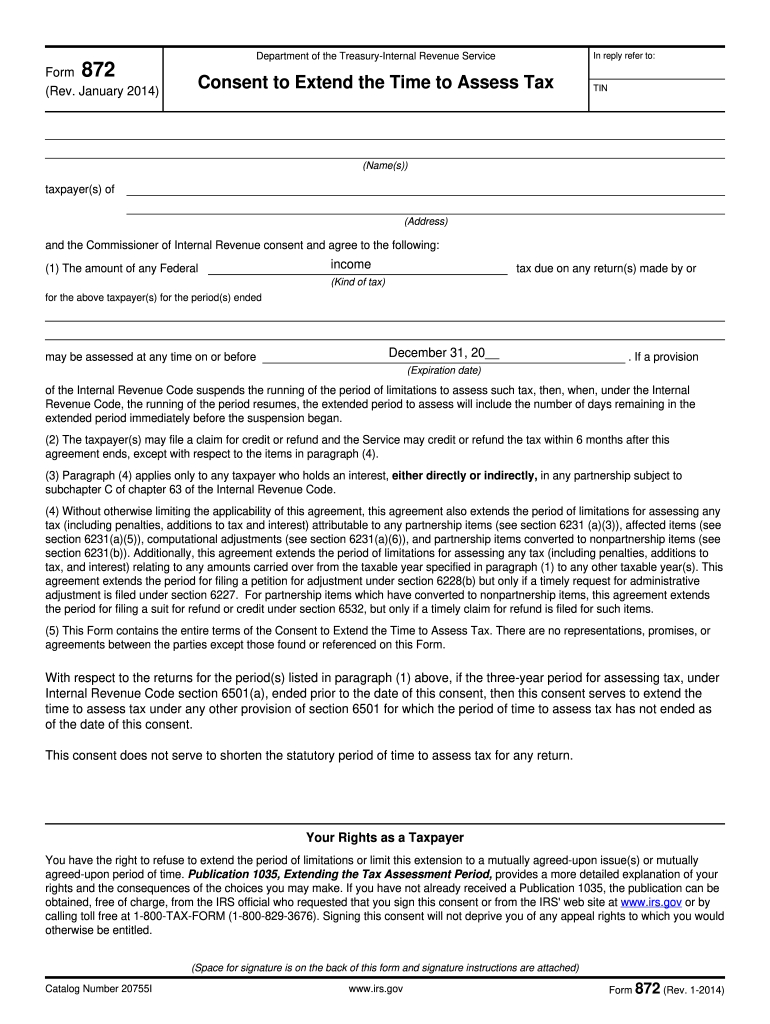

IRS 872 2014-2026 free printable template

Instructions and Help about IRS 872

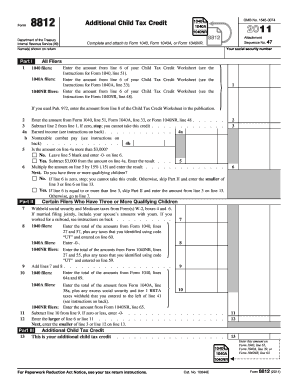

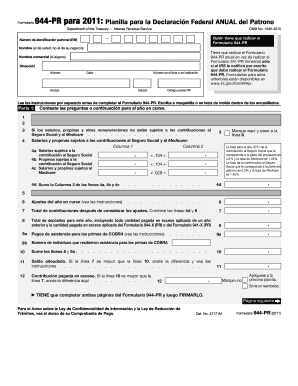

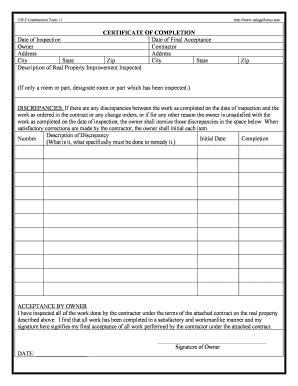

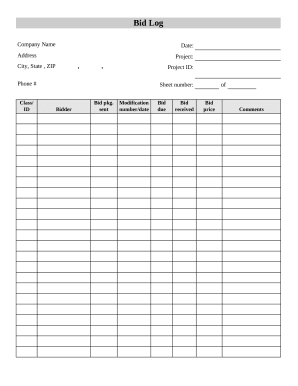

How to edit IRS 872

How to fill out IRS 872

Latest updates to IRS 872

All You Need to Know About IRS 872

What is IRS 872?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 872

What steps should I take if I discover an error in my IRS 872 after submission?

If you find an error in your IRS 872 after it has been submitted, you should file an amended form to correct the mistake. It's important to provide clear explanations for the changes made, along with supporting documentation. Be aware of the deadlines for amendments to ensure compliance and avoid potential penalties.

How can I verify if my IRS 872 has been received and processed?

To verify the status of your IRS 872, you can check online through the IRS tracking system, if available, or contact the IRS directly. Be sure to have your submission details handy for quick identification. Common e-file rejection codes can also provide insights if there are issues with your submission.

What should I do if I receive a notice or letter from the IRS regarding my IRS 872?

If you receive an IRS notice or letter related to your IRS 872, carefully read the communication to understand the IRS's request or concern. Prepare any requested documentation and respond promptly to avoid further complications. It's advisable to keep copies of all correspondence for your records.

Are there specific technical requirements I should be aware of for e-filing the IRS 872?

When e-filing the IRS 872, ensure your software or browser meets the IRS's technical requirements. This usually includes using supported file formats and ensuring your internet connection is stable. Checking for system compatibility can help prevent submission issues.