Who Needs Form 872?

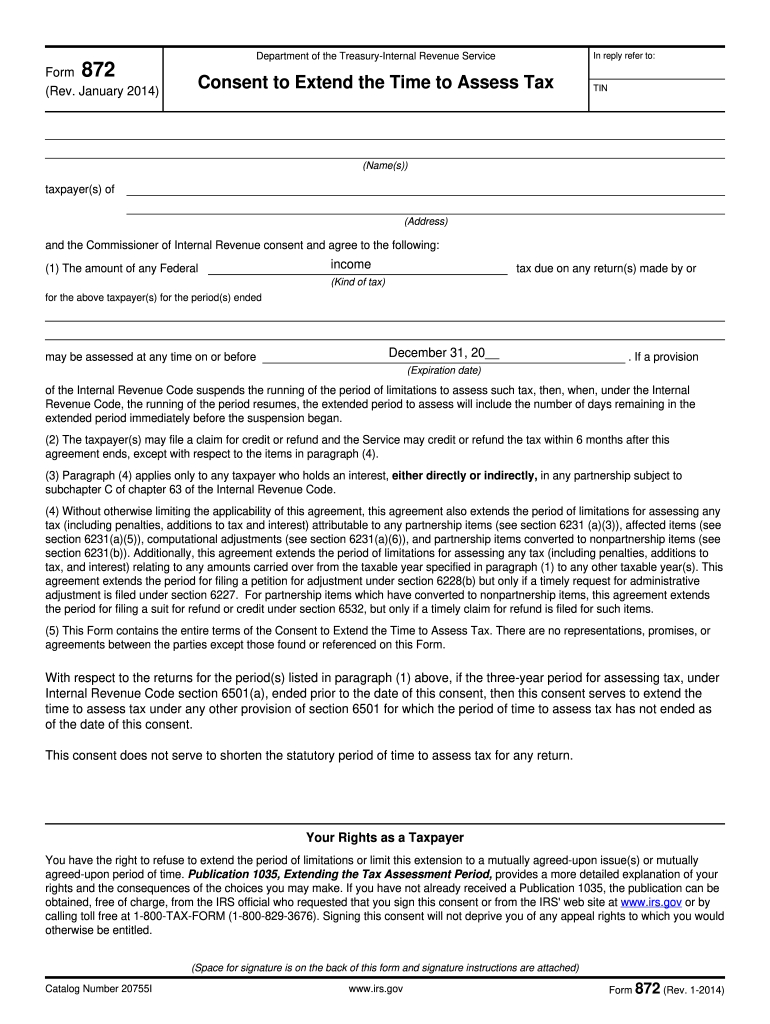

Form 872 is designed for taxpayers to reach an agreement with the IRS. Form 872 or Consent to Extend the Time to Assess Tax is sent to the taxpayer and is filed electronically.

What is Form 872 for?

Sometimes the IRS may ask a taxpayer who has been filing their tax returns regularly to extend the time to assess one of their tax returns. The reason for the IRS sending out this form may be improperly filed forms, excessive deductions claimed or not all taxes paid. With Form 872 the IRS and a taxpayer come to an agreement to set an assessment date either for more than 3 years or under three years. The consent is not obligatory to complete. A taxpayer may refuse to fill it out but then they will have to answer the IRS notice of deficiency that serves to convince a taxpayer to agree to the extension.

Is Form 872 Accompanied by other Forms?

Form 872 is not accompanied by any forms. The necessary information is included in the document. The form should be submitted in two copies.

When is Form 872 Due?

The expiration date for Form 872 falls two years after the form is sent. However, the taxpayer is expected to give an answer as soon as possible or to ask for an extension to think the issue over. The time extension should be previously agreed to with the IRS.

How do I Fill out Form 872?

Form 872 is mostly filled out by the IRS which means a taxpayer gets a complete document with the following information:

- Taxpayer’s identification Number or SSN

- Name, address, tax periods

- Expiration date

- Signatures and dates

Where do I send Form 872?

Form 872 is sent back to the IRS.